June Market Update from IFA |

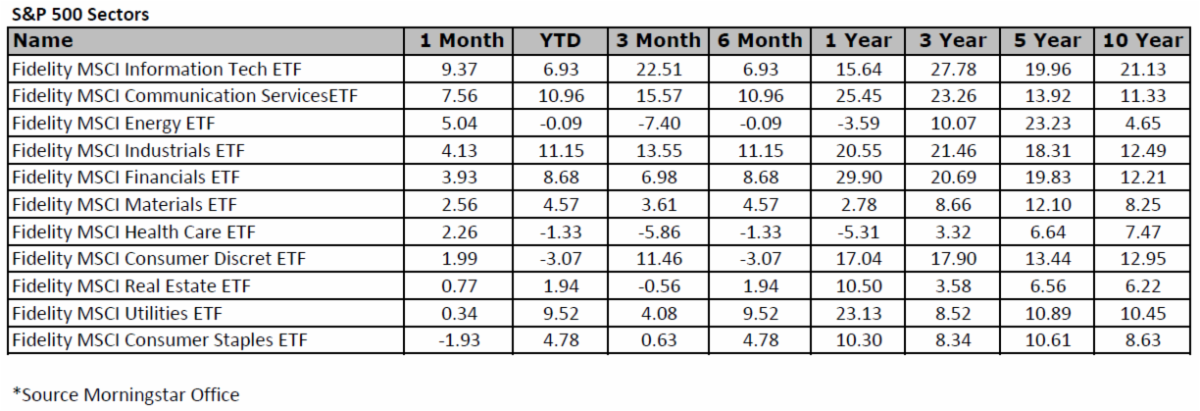

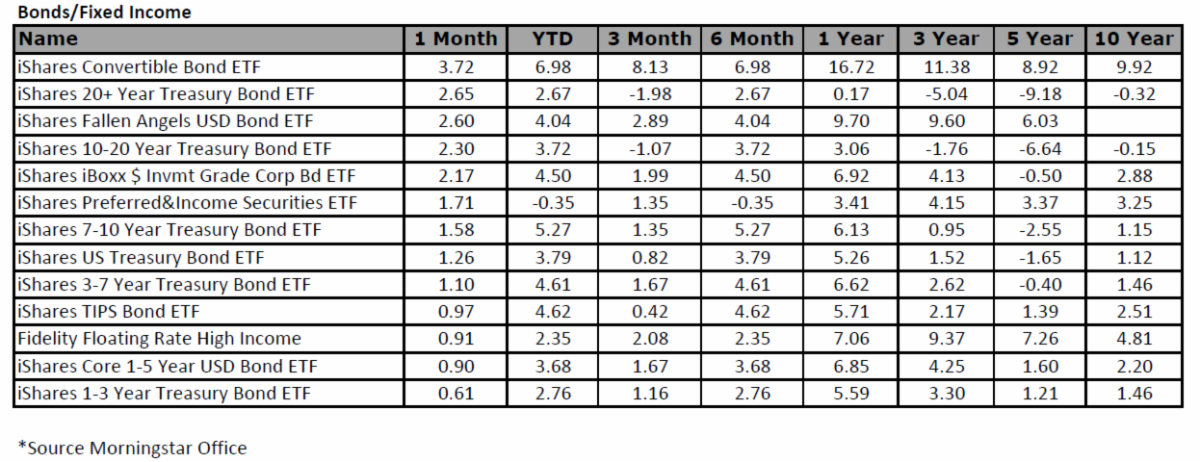

Weeks 1 – 2 This week's action in the stock market was underscored by persistent resilience to selling efforts, but ultimately the market could not avoid a lower finish with the S&P 500 losing 0.4% for the week. The modest loss masked a week that was jam-packed with news developments, starting with some optimism surrounding trade talks between officials from the U.S. and China, followed by an encouraging CPI report for May, indications of trade deals with India, Mexico, and Canada taking shape, and ending with concerns about the impact of an escalating conflict between Israel and Iran. Since 1985, the S&P 500 has averaged a 3.6% gain during the three months after oil rises 5% or more in a single day (Dow Jones market data.) Now it’s up to the economy and earnings. Thankfully, spending by consumers and tech companies like Meta Platforms and Alphabet, perhaps the two of the most important pillars of the U.S. economy, grew during the first quarter and shows no signs of slowing down despite the trade-policy chaos. As a result, analyst forecasts suggest aggregate earnings for the S&P 500 should grow 12% annually for the next three years, reaching $336 by 2027, according to FactSet. At 21 times earnings, the S&P 500 could hit 7000 by the end of 2026. Brent crude rose over 7% to more than $74 a barrel. The U.S. oil gauge, West Texas Intermediate, advanced 7.3% to about $73 a barrel. Both logged their largest one-day percentage gains since the early days of the Russia-Ukraine war, according to Dow Jones Market Data. Investors piled into traditional safe-haven assets. Gold climbed to a record level, gaining 1.5% to $3,431.20 per troy ounce. The dollar strengthened, rebounding from recent weakness stemming from tariff uncertainty. The yield on the 10-year U.S. Treasury note rose to 4.423%, with investors betting that the jump in oil prices could drive overall inflation and make it harder for the Federal Reserve to cut interest rates. Week 3 In the end, the major indices finished the week little changed, reflecting in part the indecision over the Israel-Iran situation. There was some speculation early in the week that the U.S. could get directly involved in the conflict, with President Trump demanding Iran's "unconditional surrender" and saying that his patience with Iran is wearing thin. By the end of the week, he allowed that there was still time for Iran to negotiate and that he will decide on a final course of action with respect to Iran over the course of the next two weeks. There were several key central banks decisions this week, all of which were expected. The Bank of Japan held its key policy rate steady at 0.50%, the Federal Reserve left the target range for the fed funds rate unchanged at 4.25-4.50%, and the Bank of England stood pat with its policy rate at 4.25%. The overarching message from Fed Chair Powell at his press conference was that the Fed is going to stick by its wait-and-see stance, largely because the labor market is still in pretty good shape and because the Fed is concerned that tariffs will lead to higher prices. Fed Chair Powell, for his part, said he is expecting a meaningful increase in inflation in the coming months because of the tariffs. Sector action this week featured only three sectors finishing higher: energy (+1.1%), which followed oil prices higher, information technology (+0.9%), and financials (+0.8%). The health care sector (-2.7%) was the biggest laggard, followed by communication services (-1.7%), and materials (-1.2%). The consumer discretionary sector (0.7%) also underperformed for the week, which included a report showing total retail sales down 0.9%, and sales excluding autos down 0.3%, in May. How frustrating has this year been? On a risk-adjusted basis—that is, by measuring stock gains against volatility—owning stocks has been beyond irksome. Goldman Sachs calculates that returns for the S&P 500 this year have been in the 24th percentile since 1990, while volatility has been in the 89th percentile. The news has been even worse for the S&P MidCap 400 and small-cap Russell 2000 indexes, whose returns are underwater both before and after adjusting for volatility. Week 4 The stock market had a strong week of trading in which a ceasefire between Israel and Iran, positive earnings reports, better-than-expected economic data, and some rate cut hopes culminated in the S&P 500 and Nasdaq Composite eclipsing and finishing with record highs. The S&P 500 index has gained 3.2% this week and is once again at an all-time high. The Nasdaq Composite is too. The Cboe Volatility Index, or VIX, has tumbled back to the mid-teens, a level that reflects few signs of worry, let alone panic. Quite the contrary. Investors are betting that the U.S. economy will remain resilient and are banking on strong earnings growth when companies start reporting in July. Eventual interest rate cuts from the Federal Reserve and a further de-escalation of tough talk from President Donald Trump on tariffs before his July 9 deadline for new trade deals would help, too. The S&P 500 on Friday notched its first new high since February, capping a dizzying 24% rally from the depths of April’s tariff-induced selloff. The wild 89 trading days in between records marked the swiftest-ever recovery back to a closing high after a decline of at least 15%, according to Dow Jones Market Data. Stocks have climbed in recent sessions after the fragile cease-fire between Israel and Iran sent oil prices lower and fueled optimism that the Middle East could avoid a prolonged conflict. Continued trade negotiations between the U.S. and trading partners including China and the European Union have also lifted investors’ spirits ahead of the looming deadline for tariff hikes. The country’s biggest corporations reported robust profit growth for the first quarter. The U.S. added more jobs in May than economists anticipated, while the unemployment rate held steady. And data showed consumer prices rose at a muted pace last month, defying concerns that tariffs would begin to rekindle inflation. One clue that investors don’t expect a major slowdown: The S&P 500’s top-performing sector this year is industrial stocks, a group closely attuned to the strength of the economy. Industrials have risen 11%, compared with a 5% gain by the S&P 500. *This content is developed from sources believed to be providing accurate information. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. |

|

|

|

|

|