July Market Update from IFA |

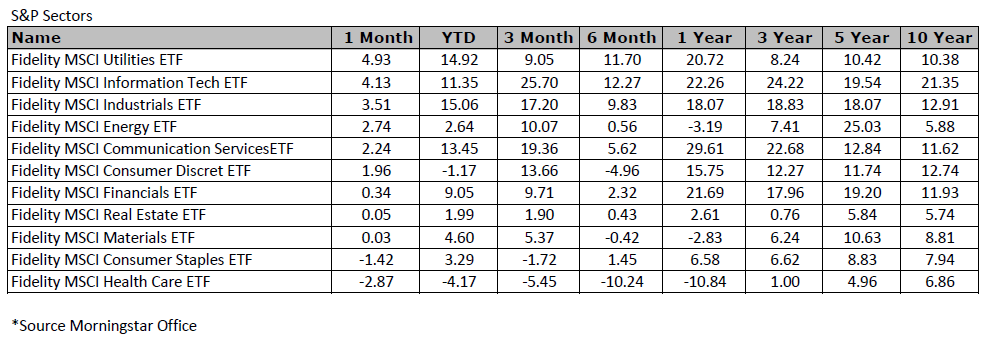

Week 1 While the S&P 500 index gained 1.7% this week and the Nasdaq Composite rose 1.6%—each closing at fresh records—the comeback since the trade crisis has been even more impressive. The S&P 500 is up 26% from the selloff low on April 8, while the Nasdaq has surged 34.9%, as the worries, from supersized tariffs to the U.S.’s artificial-intelligence dominance, have slowly faded. Yet the market didn’t have to depend on trade for a boost. The Bureau of Labor Statistics said on Thursday that the U.S. economy added 147,000 jobs in June —a figure that exceeded economists’ expectations and was a counterpoint to the slightly worrying June ADP private payrolls number released Wednesday. It almost certainly means no July rate cut, but shows the economy is still going strong. In the U.S., meanwhile, the impact of tariffs was blunted or delayed, or both, as companies stocked up on imports before the extra taxes were imposed. As a result, inflation has been under control and close to target, coming in below forecasts in both April and May. After an initial nasty selloff when the biggest tariffs were announced, stocks have fully recovered, helped by Trump’s delay to most tariffs and a few trade deals. There was nothing wrong with the jobs report either, at least not on the surface. The Bureau of Labor Statistics reported 147,000 nonfarm jobs were added in June, well above the consensus guess of 106,000 from economists surveyed by Bloomberg, which had been pared by the time of the report’s release on Friday. Revisions didn’t tarnish the report, either. The two preceding months’ payroll tally were revised up by 16,000, a trivial change but positive in direction. The clock is running out on key trade deadlines, but investors have resigned themselves to negotiations that will likely continue over the long haul as equities trade at all-time highs. Many are confident the effective tariff rate will wind up somewhere closer to 10%, a historically high level that nevertheless is better than a rate north of 25% that investors fear would result in outright recession. Coming into the year, the effective tariff rate averaged 2.5%. Even so, investors are starting to get more worried about the stock market over the near term. Many are pointing out that the S&P 500, which has returned to record highs, is now fairly valued at a time when event-driven risks have yet to abate. The broader index is trading at 23 times forward earnings. Barclays strategist Stefano Pascale was one of several this week warning clients about “froth” in the market. Week 2 The stock market had a losing week this week, but not by much. The difference was Friday’s session, which culminated with modest, but broad-based losses linked ostensibly to inflation concerns driven by tariff actions. All things considered, the indices held up relatively well, as market participants embraced the notion that the tariff letters were being used as a negotiating leverage, cognizant that there is still time to work out less onerous terms. That enthusiasm was not entirely diminished, however. The S&P 500 and Nasdaq Composite climbed to new record highs this week, aided by a better-than-expected Q2 earnings report and reassuring outlook from Delta Air Lines (DAL) and AI giant NVIDIA (NVDA) surpassing a $4 trillion market capitalization. In terms of the S&P 500, its best-performing sectors were energy (+2.5%), utilities (+0.8%), industrials (+0.6%), information technology (+0.2%), and consumer discretionary (+0.1%). The biggest laggards were the financials (-1.9%), consumer staples (-1.8%), and communication services (-1.2%) sectors. This has proven that the market has been trading on a high multiple - which isn’t something to worry about just yet. When the S&P 500 hit 22 times or higher in the past five years, it gained an average of 4.6% over the following three months, according to Dow Jones Market data. Many of those rallies spanned April, July, and October, the thick of earnings season. Plus, there have been little signs of tariff-related impacts on inflation. Data in recent months shows that inflation is continuing to trend lower, despite businesses warning that they are raising prices in response to Trump’s levies. Some analysts fret that investors are overly blasé, warning that the effect of levies could begin showing up later this year and potentially derail the economy’s resilience and send inflation higher. The tariff whiplash is also likely to continue, they say. Week 3 The equity market posted modest gains this week despite volatility stemming from earnings, economic data, Fed policy speculation, and tariff developments. The Nasdaq Composite and S&P 500 closed at or near record highs, while small caps outperformed on renewed economic optimism. The following below were the headlines of economic news this week: CPI showed core inflation at +0.2%, slightly better than expected, but price increases in apparel and furnishings raised concerns over tariff-driven inflation. PPI was unchanged month-over-month, adding to a disinflationary narrative favorable to the Fed. Retail sales rose 0.6% in June after two months of decline, signaling renewed consumer strength. Initial jobless claims fell to 221,000, consistent with a solid labor market. Housing starts and permits beat expectations on the surface, but weakness in single-unit construction and permits remains a headwind for housing supply. Consumer sentiment rose to a 5-month high, reflecting improving inflation expectations. Nasdaq Composite: Led the week, notching multiple record highs behind strength in semiconductors and AI-related names like NVIDIA and AMD. S&P 500: Also set new records, lifted by good earnings news. Russell 2000: Gained 0.2% for the week, leaving it up 3.0% for the month. Treasuries: Saw a tug-of-war between inflation optimism and Fed policy skepticism. The 2-year yield settled at 3.88%, down three basis points for the week, while the 10-year note yield settled at 4.43%, up one basis point for the week. U.S. Dollar Index: Finished the week higher, boosted by firmer inflation expectations and tariff-related concerns. Week 4 The stock market extended its rally this week, with the S&P 500 and Nasdaq Composite hitting record intraday and closing highs on Friday. The S&P 500 reached a high of 6,395.82 and closed at 6,388.64, while the Nasdaq hit 21,159.80 intraday and settled at 21,108.32. This earnings strength, combined with trade deal optimism and moderating Treasury yields, supported the bullish sentiment. Progress on trade agreements with Japan and potential deals with the EU and China eased investor concerns ahead of the August 1 tariff deadline. All 11 sectors finished higher for the week, led by health care (+3.4%), materials (+2.4%), industrials (+2.3%), communication services (+2.2%), and real estate (+2.2%). Financials (+1.7%), energy (+1.4%), and consumer discretionary (+1.2%) also posted solid gains, while defensive sectors saw modest upsides: utilities (+0.9%), information technology (+0.7%), and consumer staples (+0.01%). Despite the strong performance, six of 10 investors recently polled by Gallup are concerned about the stock market, with 58% believing the worst of the recent market volatility has yet to come. Things just aren’t that bad, though. While many investors are worried about the economy, the job market remains strong enough, a fact that should be confirmed when July’s payrolls report is released this coming Friday. And workers that do have jobs are making more than before—median average hourly earnings, tracked by the Bureau of Labor Statistics, have grown nearly two percentage points faster than inflation for the past two years after trailing inflation by one point during the two years before that. Yes, there are risks. The market is super concentrated, and Nvidia is critical to the entire market edifice. Any wobbles at the top would be problematic for the S&P 500. The top 10 stocks now account for almost 40% of the S&P 500’s market capitalization; that figure was closer to 20% near the peak of the dot-com boom at the end of 1999. The market, however, isn’t as expensive as it might appear—the 10 most valuable stocks in the S&P 500 traded for about 27 times 12-month forward earnings, cheaper than 44 times at the start of 2000. *This content is developed from sources believed to be providing accurate information. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. |

|

|

|

|

|