You may be the legal owner of your IRA or 401(k), but it comes with a giant I.O.U. to the government. Someday the money in that plan will be distributed to you and your beneficiaries, and in most circumstances these distributions will be fully taxable by the IRS.

A perfect tax storm

According to the National Association of Plan Advisors, the total value of retirement plan assets in the United States is estimated at over $30 Trillion, with over $10 trillion just in IRA assets alone.

At the same time, our national debt is nearly that amount and growing by $1 trillion or more each year. In 2020, the national debt increased by over $4 trillion and trillions more will likely be spent before the pandemic ends and our economy is fully back on track.

In 2025 the current tax law will expire. What taxes might look like after that is anyone’s guess.

In plain English, the IRS plans to take a cut of your retirement savings. It’s not a question of “if” you will owe taxes on your IRA, but of “how much” and “when”.

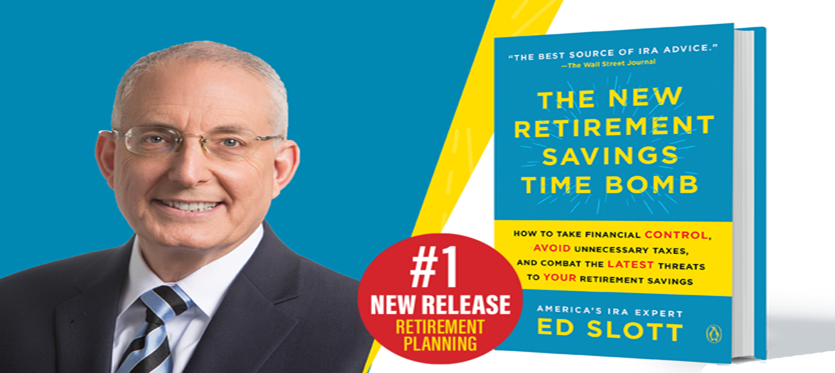

Ed Slott

As you may know, I am an active member of Ed Slott’s Elite IRA Advisor GroupSM, an organization dedicated to the ongoing study and mastery of constantly changing and complex tax laws impacting your retirement savings. Ed and his team of IRA Experts are a valued part of my back-office team to help provide you with the latest strategies to help answer your toughest questions and avoid unnecessary taxes on your retirement.

I have been part of Ed Slott’s Elite IRA Advisor GroupSM since 2007. This is where I learn how to help my clients reduce the amount of tax they may pay on their retirement savings.

I’m excited to share a one-of-a-kind opportunity to hear from Ed Slott as we celebrate the launch of his highly anticipated book, The New Retirement Savings Time Bomb.

Mark your calendar and visit irahelp.com/launchparty at 6 PM ET on March 2 to join the festivities!

To get an idea of what this event is all about, you can get a preview from Ed Slott by clicking here.

Virtual Book Launch Party

The New Retirement Savings Time Bomb

6:00 – 6:30 PM ET on Tuesday, March 2

Featuring Jill Schlesinger, CFP®

CBS News Business Analyst and Host of "Jill on Money" radio show and podcast

If you’re like most Americans, your most valuable asset is your retirement savings. We diligently put money away for years, yet most of us don’t know how to avoid the costly mistakes that can occur when it comes time to use it. A good chunk of your money can be lost needlessly to taxes and improper planning.

The New Retirement Savings Time Bomb, by America’s IRA Expert Ed Slott, shows you in clear-cut layman’s terms how to take back control of your retirement savings and your financial future. The ticking tax bomb is coming! But this easy-to-follow guide can help you lessen the taxes set out by Congress and show you how to structure your retirement savings so you can have more, keep more and make it last, no matter what. This book is a must-read for every American with savings and investments planning to retire — be it five years from now or fifty.

To discuss any of the topics in this blog or to learn more about how we can help you Cross The Bridge To A Confident Retirement, please contact me through my web site mikebranch.net, call me directly at 651-379-3935 or email me at mpbranch@focusfinancial.com.

The link to the webinar is provided for informational purposes only. It is not a recommendation or endorsement of the content or the speaker. The speaker is not affiliated with Royal Alliance.