December Market Update from IFA |

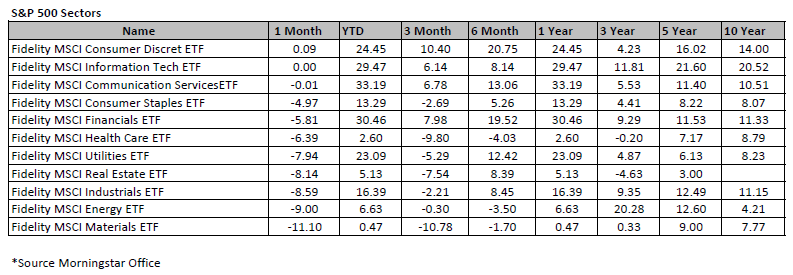

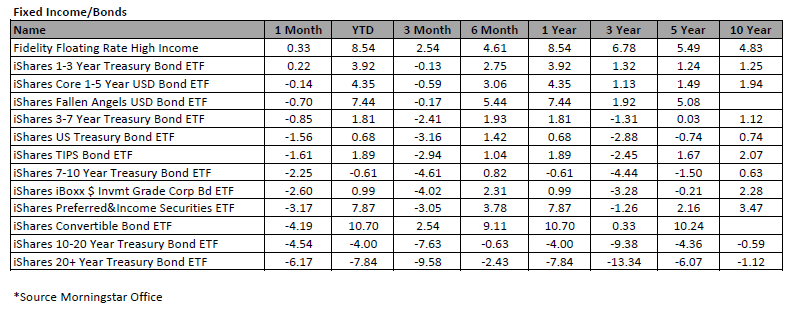

Week 1 There were only three S&P 500 sectors that finished higher this week. The upside for the market is that they carried a lot of weight and registered big gains. The consumer discretionary sector (+5.9%) led the charge followed by communication services (+4.1%), and information technology (+3.4%). The other eight sectors had a tough go of it. The consumer staples sector, which declined 0.8%, lost the least amount of ground. Otherwise, losses ranged from 1.8% (financials) to 4.6% (energy). Similarly, while the market cap-weighted S&P 500 gained 1.0% (rounding up), the Russell 2000 declined 1.1% and the S&P Midcap 400 Index fell 1.0%. On a brighter note, the S&P 500 and Nasdaq Composite both finished the week at record closing highs, holding their bullish disposition after a November employment report that was neither too hot nor too cold. In effect, it was just right for the soft landing/no landing view that left the market hopeful about continued earnings growth and another rate cut at the December 17-18 FOMC meeting. Treasuries also had another winning week. The 2-yr note yield fell six basis points this week to 4.10% while the 10-yr note yield dropped three basis points to 4.15%. Week 2 The Nasdaq Composite rocketed above 20,000 for the first time ever on Wednesday this week, less than five years after it crossed 10,000 and just weeks after the S&P 500 index crossed 6000 for the first time. But the thrill rapidly disappeared. The Nasdaq quickly retraced its gains after hitting the milestone and finished the week up just 0.3% at 19,927. The S&P 500 declined 0.6%, and the Dow Jones Industrial Average dropped 1.8%, ending Friday with a seven-day losing streak. Most stocks outside of the tech industry have been in the midst of a gradual but persistent selloff. For 10 straight days through Friday, more stocks in the S&P 500 fell than rose, the longest such streak since 2000, according to Dow Jones Market Data. For the week, the Dow posted a 1.8% decline, while the S&P 500 slid about 0.6% and ended a three-week winning streak. The Nasdaq rose 0.3% during the period. Despite November failing to deliver progress on cooling inflation, federal-funds futures point to a nearly 100% chance that policymakers will lower the benchmark interest rate by another quarter of a percentage point. The rationalization for the cut will likely hinge on Fed officials looking to bring the benchmark rate in line with current economic conditions, given that inflation has subsided significantly from its peak in 2022 and that the formerly tight labor market is normalizing. The Fed not only has to wrestle inflation into the final stage of submission, but there are many fiscal-policy outcomes in the year ahead that could shift where inflation is headed. Moreover, the labor market does have pockets of softness that bear careful watching. Week 3 The stock market logged sharp declines this week. The week started in decent form but equities hit a wall Wednesday after the Fed implied with its words and guidance that further rate cuts can wait until there is more progress on inflation. Wednesday's session in particular left the S&P 500 178 points lower, the Nasdaq Composite was 3.5% lower, and the Dow Jones Industrial Average closed more than 1,100 points lower, logging its tenth consecutive decline. This followed the FOMC's decision to cut rates 25 basis points to 4.25-4.50%, as expected. It was not a unanimous vote. Cleveland Fed President Hammack dissented in favor of leaving the target range for the fed funds rate unchanged at 4.50-4.75%. Rising market rates put added pressure on stocks. The 10-yr yield jumped 12 basis points to 4.52% and the 2-yr yield settled seven basis points higher. Small and mid-cap stocks underperformed their larger peers, leading the Russell 2000 to sink 4.5% since last Friday and the S&P Mid Cap 400 to close 4.7% lower than last week. The S&P 500 declined 2.0%, the Nasdaq Composite fell 1.8%, and the Dow Jones Industrial Average logged a 2.3% loss to end this week. Week 4 The "Santa Claus rally" period – which is the last five trading days of the year and the first two trading days of the new year) began on Tuesday, Christmas Eve. While the rally over St. Nicholas doesn't always lead to gains in the stock market, it does usually feature a positive skew. The S&P 500 closed 0.7% higher on the week, the Dow Jones Industrial Average settled 0.4% higher than last Friday, and the Nasdaq Composite was 0.8% higher this week. The S&P 500 is now down 1% for the month, and that’s certainly not the Santa Claus rally that many were expecting. Typically, December tends to be one of the best months of the year for the S&P 500, with an average gain well over 1% - hopes were high after the index notched a heady 5.7% gain in November. According to Dow Jones Market Data going back to 1950, a December decline is a rarity: The S&P 500 was positive in the month 56 times over the past 75 years. However, during the 19 years when December was a downer, it was followed by January losses 10 times, and the index recorded a loss for the entire year afterward five times. The S&P 500 advanced 0.7% this week after posting its best Christmas Eve performance since 1974 on Tuesday. The last two trading days of the year saw the market return that gain from last week and then some, however, the market was down 1.7% to end the final trading sessions of 2024, mostly due to investors taking some well-earned profits off the top of a very nice year in the market. *This content is developed from sources believed to be providing accurate information. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. |

|

|

|

|

|