It was the poet T.S. Eliot who once lamented that “April is the cruelest month”. Ben Franklin famously said, “In this world nothing can be said to be certain, except death and taxes”. And then there is Pink Floyd who captured the sentiment of so many, “Money. Get Back! I'm alright, Jack, keep your hands off my stack...Money. It's a crime. Share it fairly, but don't take a slice of my pie”. Anyone who has ever looked closely at a paycheck to see the deductions can appreciate those lyrics. It doesn’t mean that we have to enjoy paying those taxes, however.

Carolanne’s Corner

Whenever I think about taxes and their impact on income, I am reminded of that old adage, it’s not what you make, it’s what you keep. Just consider how much time is spent in virtually every national election talking about how a candidate proposes to lower taxes. But even with debates around taxes, they never seem to go away or even go down. Clearly, it is up to the individual taxpayer to figure out how to best apply the laws to their situation to figure out how to limit reductions to their income. That’s where a good financial plan comes in. With the right tax strategies, it is possible to keep more of what you earn.

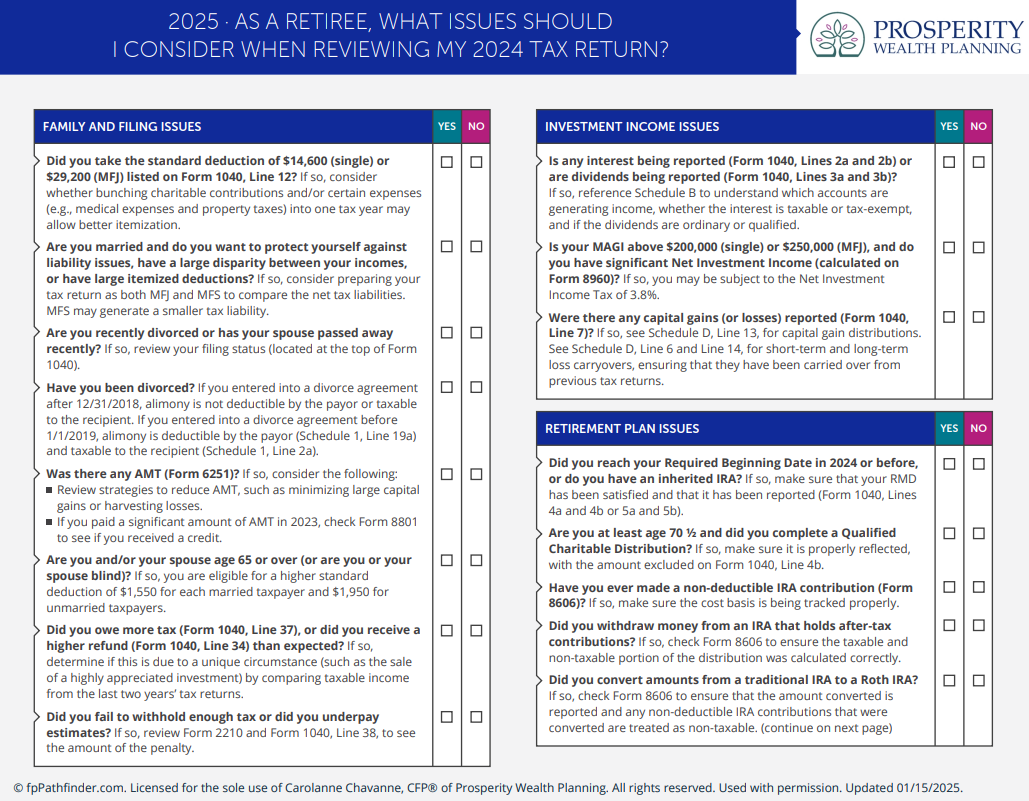

With tax season soon behind us, it’s a great time to shift the focus from tax preparing to tax planning. Many people think about taxes only when they’re due, but proactive tax planning throughout the year can help you hold on to a little more of what you worked for. Making strategic moves now can help you realize a lower tax bill next year. Small adjustments made throughout the year can lead to significant tax savings, especially when paired with a long-term wealth management strategy.

One of the most effective ways to reduce taxable income is by maximizing contributions to tax-advantaged accounts. If you’re still working, increasing contributions to your 401(k), IRA, or Health Savings Account (HSA) can provide immediate tax benefits by lowering your taxable income. If you’re self-employed, options like a SEP IRA or Solo 401(k) allow for even greater contributions. For retirees, strategies like Roth conversions—moving funds from a traditional IRA to a Roth IRA—can help manage future tax liabilities by taking advantage of lower tax brackets in certain years. By converting smaller amounts at strategic points over time, it is possible to minimize taxes on withdrawals in retirement while also reducing the impact of required minimum distributions (RMDs) down the road.

Charitable giving can help reduce taxes, especially when using strategies like donating appreciated stock instead of cash or bundling multiple years’ worth of donations into a Donor Advised Fund (DAF). Charitable donations of stocks that have increased in value have the dual benefit of allowing you to avoid capital gains taxes while still receiving a charitable tax deduction. If you’re over 70½, a Qualified Charitable Distribution (QCD) from your IRA allows you to donate up to $100,000 directly to a charity without counting as taxable income, which can be a great way to satisfy RMDs while supporting causes you care about. For those with taxable investment accounts, tax-loss harvesting—selling investments at a loss to offset capital gains—can be a valuable tool to manage tax exposure while keeping your portfolio aligned with your financial objectives.

It is important to remember that, as the year progresses, reviewing taxes withheld and estimated payments can help prevent some of those unpleasant surprises next April. Adjusting these amounts based on changes in income, deductions, or tax law updates help to ensure that you’re not overpaying or underpaying. If you’ve experienced a significant life event—such as a job change, marriage, birth of a child or retirement—updating your tax plan now can help avoid a last-minute scramble. Additionally, staying informed about potential tax law changes may reveal ways to take advantage of new opportunities or adjust strategies accordingly. If you’d like to discuss personalized strategies for reducing your tax burden, let’s set up a time to review your financial plan and identify opportunities to save. Proactive planning today can lead to a more efficient, tax-smart financial future.

Jordan’s Journal

Looking back at market performance so far in 2025, market volatility has remained front and center. The S&P 500 recently entered correction territory, dropping 5.1% year-to-date as investors digest a wave of policy changes, ongoing trade uncertainty, and shifting economic forecasts. However, it’s important to remember that short-term market moves are often driven by reactions to policy uncertainty rather than fundamental economic weakness.

One of the biggest factors influencing recent market swings has been the reintroduction of tariffs on key imports. The increased tariff rates, particularly on Chinese goods and the automotive sector, have sparked concerns about rising costs for businesses and potential slowdowns in global trade. While these policy shifts have introduced short-term uncertainty, history shows that markets adjust as businesses find ways to adapt.

Meanwhile, the Federal Reserve continues to hold steady on interest rates, with expectations of possible cuts to come later in the year as inflation (and inflation fears) continues to ease. The latest data shows that inflation remains slightly above the Fed’s 2% target, but overall trends point to gradual improvement, reducing the likelihood of aggressive rate hikes.

Despite market turbulence, the broader economy remains resilient. Inflation has continued its downward trend, job growth has been steady, and consumer spending—while facing some headwinds—continues to hold up. GDP growth has also exceeded expectations, with the Federal Reserve now projecting real GDP to grow by 1.7% in 2025. The latest projections from the Atlanta Fed’s GDPNow model suggest the economy is still expanding at a healthy pace, although some analysts have lowered long-term forecasts due to policy uncertainty and tariffs. Even so, economic growth remains a positive factor for corporate earnings and long-term market stability.

Turning to consumer behavior, March retail sales are forecasted to rise 1.4% year-over-year, supported by stronger tax refund disbursements and steady household spending. Additionally, recent corporate earnings reports from major companies like Apple, Starbucks, and Visa reflected varied performance. Apple posted record revenue and earnings growth, Starbucks reported flat revenues with declining global sales, and Visa saw strong transaction growth and increased revenue. These results highlight the mixed impact of current economic conditions across different industries.

While analysts have adjusted their market forecasts slightly downward due to higher tariffs and policy uncertainty, these adjustments reflect a more cautious sentiment rather than a fundamental weakness in earnings growth.

The key takeaway is that while policy changes can create short-to-medium-term market swings, they don’t dictate the long-term trajectory of the economy. Fundamentals such as employment, GDP growth, corporate earnings, and inflation trends remain solid, providing a strong foundation for future growth. Historically, markets have weathered periods of uncertainty before rebounding. Staying diversified and focused on long-term goals remains the best approach in times like these.

As always, we’re here to help you navigate the market’s ups and downs. If you have any questions or want to discuss how these changes impact your portfolio, don’t hesitate to reach out.

News and Upcoming Events

Legacy Planning Program

Our clients have responded positively to our Legacy Planning Program and are looking forward to its implementation. The program is designed to help educate and prepare the next generation for their financial future, and is built around three pillars -

- Investment Guidance – Using planning strategies with investment models appropriate for clients' adult children with a longer investment horizon, we’ll also provide annual financial and investment plan review meetings focused on their goals.

- Financial Education – Education is a building block of future success in life, but financial education is an often-overlooked component. Our Financial Education pillar will offer tools and learning modules with the flexibility to adjust to a young adult's learning preferences.

- Family Legacy Planning Sessions– Planning meetings for your family designed to encourage open communication and discuss your legacy plan to prepare your family for future wealth transition.

We recently announced the Investment Guidance pillar to our current legacy clients. Information regarding the Financial Education and Family Legacy Planning Sessions will be shared soon!

Supercharge Your Finances

Our March episode featured a special guest speaker, Theresa Klewsaat, from Ryan Insurance. Theresa joined Carolanne and Jordan in a discussion on Long-term Care insurance. Theresa brings a lifetime of personal and professional experience in this area. Here’s is the link, if you haven’t had a chance to listen to it yet. You can also catch up on any past episodes on our website.

Spring Prosperity Planning Sessions

We are at the midway point of our Spring Prosperity Planning Sessions. We have had an overwhelming response from clients to our spring sessions and you have enjoyed the “What If?” scenario planning. In fact, when asked what you would do differently if money wasn't a concern, 10% of you mentioned you are already “living the dream!”. That brings joy to us to hear.

Tax Planning Sessions

Remember it's not what you earn, it's what you keep. Our summer tax planning sessions are right around the corner. We will be holding sessions from June 16th– August 1st with the Texas in-person sessions being held during our next trip, June 23rd – 27th. We will start scheduling appointments in May.

Client Appreciation Events

It’s never too early to start planning for our favorite event of the year – our annual Client Appreciation Events in Texas and California. This year we will be holding the Texas event on October 8th and the California event will be held a month later on November 6th. Be on the lookout for more information as we get closer to the dates. We hope to see all of you there!

aMAYZing Kids Golf Tournament

Prosperity Wealth Planning will be partnering with aMAYZing Kids for a charity golf tournament on September 26, 2025. aMAYZing Kids is a nonprofit pediatric therapy clinic located in South Orange County, California. Their mission is to provide compassionate and comprehensive care to children of all abilities, with a focus on occupational therapy, speech therapy, and physical therapy. They believe that every child deserves the chance to reach their full potential, regardless of the challenges they may face. Click here to learn more about the truly inspiring work they do.

The golf tournament will be held at Tijeras Creek Golf Course in Rancho Santa Margarita, California. Keep an eye out for more information, including registering for the event, as we get closer to the date.

Articles of Interest

Taxes are an unfortunate fact of life for all of us. However, they don’t have to be as bad as they seem to be. We are here to help you navigate through the tax laws and determine a way forward that will help you hang on to more of what you work so hard for. If this years' experience paying taxes is one you don’t want to repeat, or if you just have questions about the strategies you are using to manage your taxes currently, please reach out and let us know how we can help. I wish you the best that spring can offer and look forward to seeing you soon.

Carolanne and the Prosperity Wealth Planning Team