Overview

Chegg is a holding in our J2 Dynamic MidCap Growth stock strategy. In early March as the market was selling off we reviewed Chegg's 4Q 2019 earnings report and came away very impressed with their organic growth and brand recognition amongst college students.

Chegg reported earnings February 10th and despite a strong earnings report the stock got caught up in the COVID market crash during this time. As I discussed the merits of Chegg with our portfolio manager John Benedict he wondered if it's possible if a move to virtual learning would further enhance the story for a company like this. John Benedict has three school-age kids and witnessed first hand the swift move to virtual learning for his kids. The more we researched what was going on with other schools across the nation the more we liked the story. On March 26th we decided to initiate a position for clients despite the market selloff.

What does Chegg do?

Chegg is an online learning platform for students. Chegg mainly focuses on high school and college students and offers students an opportunity to take control of their own education. What started as a way to buy and exchange textbooks evolved into an online study and tutoring service. Chegg offers multiple services that include study materials, writing practice, tutors, and math solving software.

Our Current Investment Thesis

COVID-19 has pulled forward the technological shift in the education sector. With the uncertainty of in-person schools in the fall, students and parents will have to find alternative forms of education.

Chegg services are available online, anytime, anywhere and they have the ability to reach students regardless of economic shutdowns or school delays. With no direct access to professors and teachers, we believe students will need to seek alternatives to help further their education.

Chegg services align perfectly with the demand that is likely to come this fall. Chegg was already growing at a healthy clip (29% YoY in 2019), and we believe this growth will only continue as, almost overnight, schools have been forced to move entirely online. Students were already making the shift to online education; COVID just sped up the process. We believe that this high demand will be met with services like those offered by Chegg, and students will soon realize that they can receive high-quality, low-cost, personalized education services right from their own home.

Earnings Highlights & Financials

Q1 2020 Highlights:

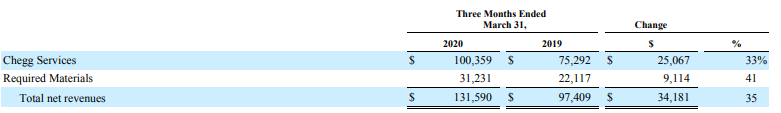

• Total Net Revenues of $131.6 million, an increase of 35% year-over-year

• Chegg Services Revenues grew 33% year-over-year to $100.4 million, or 76% of total net revenues, compared to 77% in Q1 2019

• 2.9 million: number of Chegg subscribers, an increase of 35% year-over-year

Earnings Call Quotes

- "Subscriber growth of 67% year-over-year including our Mathway subscribers reaching a record 3.7 million students. This yielded a net revenue growth of 63% year-over-year in Q2 alone. To put that in perspective, we had more subscribers in Q2 of this year than we had in all 2018."

- "We anticipate that we're going to be a high growth, high margin company for years to come and we want to lean in and invest in that future growth."

Revenue Breakdown

- The majority of Chegg’s revenue comes from the service side of the business. This aspect of the business also offers high margins, which allows for greater expansion of the business over time as it grows its user base.

Services

So with most of its revenue coming from the service side, what kind of services does Chegg offer?

- Chegg Study

Chegg Study is a subscription service that helps students learn concepts on their own through the use of “Expert Answers,” “Textbook Solutions,” video content, and practice quizzes.

Chegg Writing

This service provides tools with capabilities such as citation creation, bibliography creation, anti-plagiarism, grammar checks, spell checks, and instant feedback to help students revise, edit, and improve their written work.

Chegg Tutors

With Chegg Tutors, students can find human help on the platform through their live tutor network. Qualified tutors are readily available to assist with a variety of subjects.

Chegg Math Solver

The Chegg Math Solver is a step-by-step math problem solver and calculator that allows students to solve algebra and calculus problems with ease,

Thinkful

Via Thinkful, students across the United States can directly access professional courses in software engineering, data science, data analytics, product design, and product management.

Growth

- We believed the total addressable market for online education was large even before COVID-19 and these stay-at-home efforts will only serve to further propel the growth of this market.

Brand Recognition

Chegg already has a strong presence among college students, and with many students seeking alternative forms of education, we believe Chegg will continue to be recognized as a well-known brand when it comes to online education.

Effectiveness

- Not only are students switching over to this education alternative but its effectiveness has been rated as good amongst surveyed users.

Technical Chart

- When we took a position in late March, CHGG was setting up a base in what looked like a longer-term cup and handle pattern.

- The $45 dollar mark was a key pivot point and breakout area we were targeting and the better than expected earnings helped push through that level on heavy volume.

- Since the breakout, the price hasn't looked back, tacking on gains of over 100% since our initial position.

Conclusions

When J2 looks for stocks in our Dynamic Mid-Cap Growth Strategy, we look for: revenue acceleration, EPS acceleration, high margins, high return on equity, relative strength, and favorable technical trading setups. Chegg checked all of our boxes back in March when we initiated a position. This is a great example of our process when considering growth stocks, and when things align it can result in a great addition to the portfolio. We plan to add to Chegg on pullbacks as long as the thesis and earnings remain intact.

Checklist

Revenue accelerated 35%

Earnings per share accelerated 47%

Gross margins 67.8%

Return on equity 27.5%

Top of our relative strength Buy List

Cup and Handle breakout trading setup